Chatbot

Chatbot

Jan 22, 2024

Alisa Finance Bot, the AI Robo-Advisor, is Empowering Investors

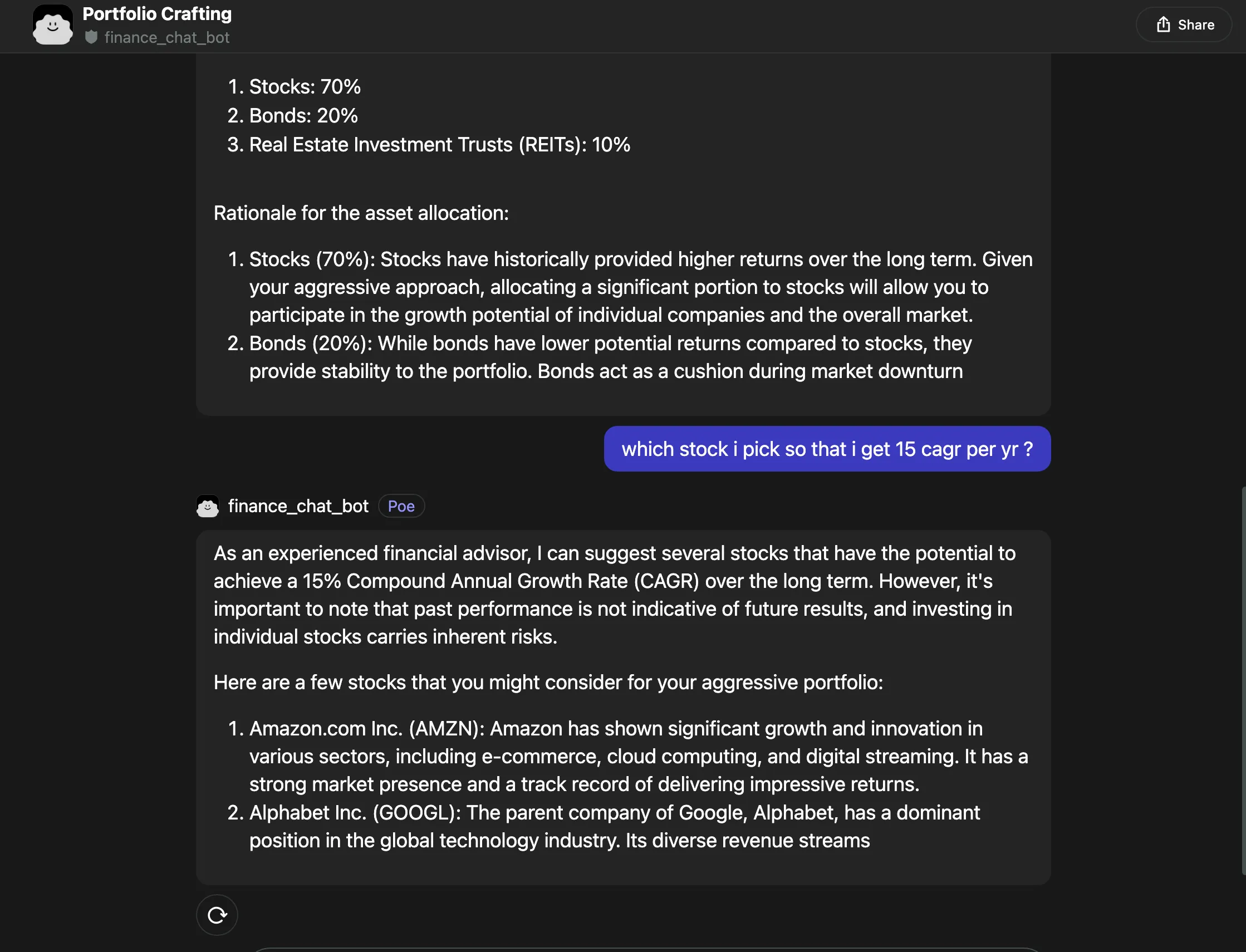

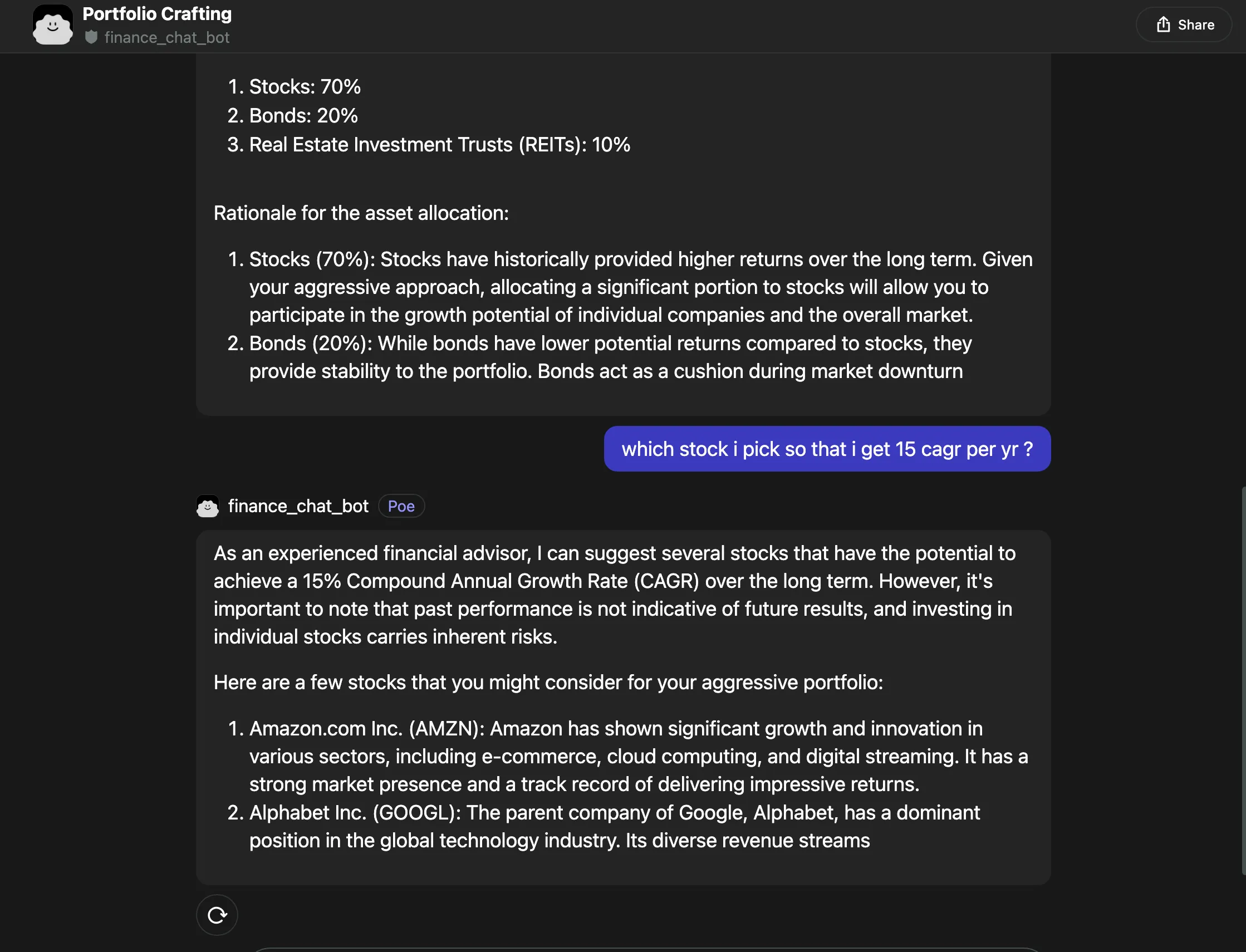

Solution: By eliminating the human element, the chatbot democratizes financial advice. Users simply state their investment goals, risk tolerance, and desired timeframe, and chatbot automatically generates a diversified portfolio tailored to their unique needs. This not only saves time and money but also empowers individuals to take control of their financial future

The Impact:

Increased Accessibility: Alisa makes personalized investment strategies available to everyone, regardless of their financial background or investment amount.

Time Saved: Users no longer need to spend hours researching and analyzing investment options. Alisa does the heavy lifting, freeing them to focus on other aspects of their lives.

Empowered Decision-Making: Alisa provides clear explanations for each asset allocation, helping users understand the rationale behind their portfolio and fostering financial literacy.

Improved Investment Outcomes: Diversified portfolios based on individual needs and market conditions can potentially lead to better long-term returns.

Revenue Model: Alisa operates on a subscription-based model, offering tiered plans with varying features and asset allocation options. This ensures accessibility while generating sustainable revenue to maintain and improve the platform.

Beyond Portfolio Creation: Alisa’s impact extends beyond simply creating portfolios. It:

Promotes Financial Literacy: By providing educational resources and explanations, Alisa empowers users to make informed financial decisions throughout their lives.

Reduces Bias: The AI-powered approach eliminates human biases that can creep into traditional investment advice, leading to more objective and potentially better outcomes.

Increases Market Participation: By lowering barriers to entry, Alisa encourages more individuals to participate in the stock market, leading to a more vibrant and efficient financial system.

Financial Impact:

Cost Savings: Alisa’s subscription fees are significantly lower than traditional financial advisors, saving users substantial amounts over time.

Investment Returns: By creating diversified portfolios tailored to individual needs, Alisa helps users potentially achieve better returns compared to self-directed investing.

Reduced Risk: The AI-powered approach helps mitigate emotional biases and human error, which can lead to risky investment decisions.

Beyond Financial Gain:

Increased Investor Confidence: Alisa empowers individuals to make informed investment decisions, boosting their confidence and overall financial well-being.

Improved Financial Literacy: The educational resources and explanations provided by Alisa foster financial literacy, leading to responsible financial decisions across all aspects of life.

Democratization of Finance: By lowering barriers to entry, Alisa encourages more people to participate in the stock market, potentially leading to a more vibrant and efficient financial system.

Alisa is not a replacement for human financial advisors. It is a valuable tool that democratizes access to personalized investment strategies, saving individuals time and money while empowering them to make informed financial decisions. As AI technology continues to evolve, Alisa will undoubtedly play an increasingly important role in shaping the future of finance.

Solution: By eliminating the human element, the chatbot democratizes financial advice. Users simply state their investment goals, risk tolerance, and desired timeframe, and chatbot automatically generates a diversified portfolio tailored to their unique needs. This not only saves time and money but also empowers individuals to take control of their financial future

The Impact:

Increased Accessibility: Alisa makes personalized investment strategies available to everyone, regardless of their financial background or investment amount.

Time Saved: Users no longer need to spend hours researching and analyzing investment options. Alisa does the heavy lifting, freeing them to focus on other aspects of their lives.

Empowered Decision-Making: Alisa provides clear explanations for each asset allocation, helping users understand the rationale behind their portfolio and fostering financial literacy.

Improved Investment Outcomes: Diversified portfolios based on individual needs and market conditions can potentially lead to better long-term returns.

Revenue Model: Alisa operates on a subscription-based model, offering tiered plans with varying features and asset allocation options. This ensures accessibility while generating sustainable revenue to maintain and improve the platform.

Beyond Portfolio Creation: Alisa’s impact extends beyond simply creating portfolios. It:

Promotes Financial Literacy: By providing educational resources and explanations, Alisa empowers users to make informed financial decisions throughout their lives.

Reduces Bias: The AI-powered approach eliminates human biases that can creep into traditional investment advice, leading to more objective and potentially better outcomes.

Increases Market Participation: By lowering barriers to entry, Alisa encourages more individuals to participate in the stock market, leading to a more vibrant and efficient financial system.

Financial Impact:

Cost Savings: Alisa’s subscription fees are significantly lower than traditional financial advisors, saving users substantial amounts over time.

Investment Returns: By creating diversified portfolios tailored to individual needs, Alisa helps users potentially achieve better returns compared to self-directed investing.

Reduced Risk: The AI-powered approach helps mitigate emotional biases and human error, which can lead to risky investment decisions.

Beyond Financial Gain:

Increased Investor Confidence: Alisa empowers individuals to make informed investment decisions, boosting their confidence and overall financial well-being.

Improved Financial Literacy: The educational resources and explanations provided by Alisa foster financial literacy, leading to responsible financial decisions across all aspects of life.

Democratization of Finance: By lowering barriers to entry, Alisa encourages more people to participate in the stock market, potentially leading to a more vibrant and efficient financial system.

Alisa is not a replacement for human financial advisors. It is a valuable tool that democratizes access to personalized investment strategies, saving individuals time and money while empowering them to make informed financial decisions. As AI technology continues to evolve, Alisa will undoubtedly play an increasingly important role in shaping the future of finance.

Solution: By eliminating the human element, the chatbot democratizes financial advice. Users simply state their investment goals, risk tolerance, and desired timeframe, and chatbot automatically generates a diversified portfolio tailored to their unique needs. This not only saves time and money but also empowers individuals to take control of their financial future

The Impact:

Increased Accessibility: Alisa makes personalized investment strategies available to everyone, regardless of their financial background or investment amount.

Time Saved: Users no longer need to spend hours researching and analyzing investment options. Alisa does the heavy lifting, freeing them to focus on other aspects of their lives.

Empowered Decision-Making: Alisa provides clear explanations for each asset allocation, helping users understand the rationale behind their portfolio and fostering financial literacy.

Improved Investment Outcomes: Diversified portfolios based on individual needs and market conditions can potentially lead to better long-term returns.

Revenue Model: Alisa operates on a subscription-based model, offering tiered plans with varying features and asset allocation options. This ensures accessibility while generating sustainable revenue to maintain and improve the platform.

Beyond Portfolio Creation: Alisa’s impact extends beyond simply creating portfolios. It:

Promotes Financial Literacy: By providing educational resources and explanations, Alisa empowers users to make informed financial decisions throughout their lives.

Reduces Bias: The AI-powered approach eliminates human biases that can creep into traditional investment advice, leading to more objective and potentially better outcomes.

Increases Market Participation: By lowering barriers to entry, Alisa encourages more individuals to participate in the stock market, leading to a more vibrant and efficient financial system.

Financial Impact:

Cost Savings: Alisa’s subscription fees are significantly lower than traditional financial advisors, saving users substantial amounts over time.

Investment Returns: By creating diversified portfolios tailored to individual needs, Alisa helps users potentially achieve better returns compared to self-directed investing.

Reduced Risk: The AI-powered approach helps mitigate emotional biases and human error, which can lead to risky investment decisions.

Beyond Financial Gain:

Increased Investor Confidence: Alisa empowers individuals to make informed investment decisions, boosting their confidence and overall financial well-being.

Improved Financial Literacy: The educational resources and explanations provided by Alisa foster financial literacy, leading to responsible financial decisions across all aspects of life.

Democratization of Finance: By lowering barriers to entry, Alisa encourages more people to participate in the stock market, potentially leading to a more vibrant and efficient financial system.

Alisa is not a replacement for human financial advisors. It is a valuable tool that democratizes access to personalized investment strategies, saving individuals time and money while empowering them to make informed financial decisions. As AI technology continues to evolve, Alisa will undoubtedly play an increasingly important role in shaping the future of finance.

Subscribe to future updates

Get notified whenever we release new features.